INTERNATIONAL FUEL

TAX AGREEMENT

NATIONAL FILING DIVISION

FEDERAL APPLICATIONS PROCESSOR

Important Notice:

Scroll to ApplicationsWe've extended our October incentive through March 31st! Now, any clients who sign up for a new or renewed IFTA account license through March 31st will receive

Regulation Overview

Name: INTERNATIONAL FUEL TAX AGREEMENT

Regulation Code: State-specific

Due Date: Previous Quarter reported in the following month.

- Quarter 1: April 30

- Quarter 2: July 31

- Quarter 3: October 31

- Quarter 4: January 31

Requirement: Mandatory

Who is it for?:

- GVWR over 26,000 lbs. or 11,797 kgs.

- 3-axles + regardless of weight.

- Used in Interstate Commerce

Questions: (240) 544-0960

Email: IFTA@HOFFENMER.COM

Chat: CHAT WITH AGENT

IFTA Services Overview

-

The International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel use taxes by motor carriers operating across multiple jurisdictions. This service provides comprehensive support for IFTA quarterly filings, renewals, and account setup across all applicable states, ensuring compliance with IFTA regulations for smooth operations.

IFTA Quarterly Filings

Managing IFTA quarterly tax returns requires accurate reporting of fuel purchased and miles traveled across different jurisdictions. Filing services ensure timely submission of the necessary documents, minimizing the risk of penalties and audits. Each quarterly filing includes:

- Calculation of fuel taxes based on miles traveled and fuel consumed in each jurisdiction.

- Preparation of detailed reports for submission to the appropriate authorities.

- Monitoring of due dates to ensure compliance with state-specific requirements.

IFTA Account Setup

Setting up an IFTA account is crucial for carriers operating in multiple states or provinces. This process involves registering with the appropriate state authority to obtain an IFTA license and decals. Assistance includes:

- Guidance through the application process for a new IFTA license.

- Provision of the required IFTA decals for qualified motor vehicles.

- Clarification of state-specific requirements and regulations to ensure proper registration.

IFTA Renewals

Annual IFTA license renewals are essential for continued operations. Services include the preparation and submission of renewal applications to maintain the validity of the IFTA license and decals. The renewal process ensures:

- Timely updates to IFTA licenses to avoid service interruptions.

- Support with any additional documentation required for the renewal process.

- Reminders and tracking of renewal dates to maintain compliance.

IFTA Regulations and Compliance Information

Understanding IFTA regulations is key to avoiding penalties and ensuring smooth operations. The International Fuel Tax Agreement requires carriers to adhere to specific rules regarding fuel tax reporting, record-keeping, and mileage tracking. Important aspects of IFTA compliance include:

- Record-Keeping Requirements: Detailed records of fuel purchases, mileage, and routes taken must be maintained. This information is critical for accurate reporting during quarterly filings.

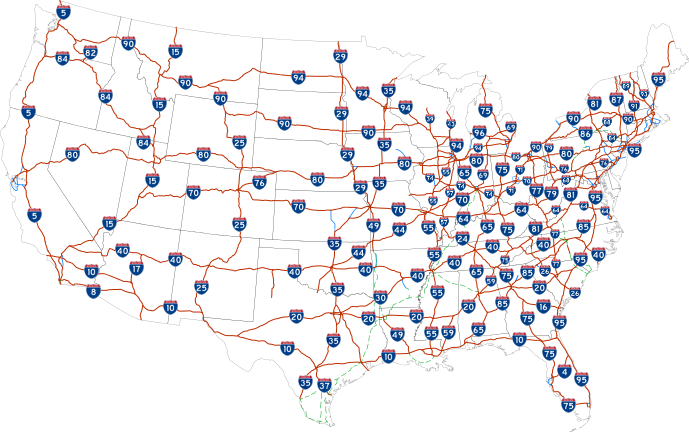

- Jurisdictional Reporting: Fuel taxes must be reported based on miles driven and fuel purchased within each member jurisdiction, including both states and Canadian provinces that participate in IFTA.

- License and Decals: An IFTA license and decals must be displayed on all qualified vehicles. The license allows carriers to report fuel use through a single jurisdiction rather than registering in each state traveled.

State-Specific IFTA Requirements

Each state participating in the International Fuel Tax Agreement may have unique requirements and processes for registration, renewals, and tax calculations. Services provide insights into:

- Specific regulations that apply to each state or province, ensuring compliance across different jurisdictions.

- Variations in reporting formats and requirements, tailored to meet each state's guidelines.

- Assistance with handling discrepancies or audits related to IFTA filings and reporting.

Why Choose Professional IFTA Services?

Navigating the complexities of IFTA regulations and ensuring accurate filings can be challenging. Professional support helps to streamline this process, offering:

- Peace of mind through expert handling of filings, renewals, and account management.

- Reduction of administrative burden, allowing carriers to focus on their core operations.

- Compliance with all IFTA requirements, reducing the risk of penalties and fines.

SELECT ONE OF THE FOLLOWING IFTA APPLICATIONS:

IFTA October 2024 to March 2025 Promotion Eligibility Terms

1. IFTA Account Status

The IFTA account must be maintained in GOOD STANDING to ensure timely renewal processing and the filing of quarterly returns. Accounts with missing or incomplete previous quarterly filings will experience delays in renewal processing and may incur additional fees to bring the account into GOOD STANDING.

2. Impact of Other Tax Accounts

If other tax accounts associated with the applicant, such as franchise, personal, or sales tax accounts, are NOT in GOOD STANDING, it may result in a delay or denial of the IFTA renewal application.

3. Accuracy Requirements for Fuel and Mileage Data

Submitting inaccurate mileage or fuel reports may result in additional fees for corrections and adjustments. Mileage Per Gallon (MPG) reports must fall within a range of 2 to 8 MPG. Submissions outside of this range are subject to rejection or denial by the state.

4. Authorization and Power of Attorney

By signing the application, the applicant grants express authority for filing and reporting to be conducted on their behalf. A notarized Power of Attorney (POA) may be required before proceeding with the filing and reporting process.

5. Conditions for Free Quarterly IFTA Tax Filings for 2025

Eligibility for free quarterly IFTA tax return filings for all four quarters of 2025 is strictly conditional upon the timely submission of accurate fuel and mileage data. The required data must be submitted no later than five (5) days prior to the IFTA quarterly tax filing due date for each quarter to maintain eligibility for the incentive.

6. Consequences of Late Data Submission

Failure to provide the required mileage and fuel data by the specified deadline will immediately forfeit eligibility for the free filing incentive. In such cases, the applicant will be required to submit supplemental information:

- A fee of $35 will be applied if providing Electronic Logging Device (ELD) login credentials or fuel card credentials.

- A fee of $150 PER HOUR ($150/HR) will be incurred for submitting physical copies of fuel receipts.

7. Requirement for Accurate Data

To retain eligibility for the free filings, it is imperative that miles traveled and gallons of fuel purchased are reported accurately for each quarter. Submitting such data at least five days before the due date is mandatory. Failure to do so will result in the loss of the free filing incentive and the imposition of additional charges as outlined above.

8. IFTA Renewals

IFTA accounts must be maintained in good standing to qualify for renewal processing. Accounts that are flagged by the state as delinquent are ineligible for renewal until they meet the required standards of good standing. The Processor reserves the right to assess additional charges as necessary to bring accounts into good standing. This includes the processing of outstanding quarterly tax returns and any penalties or fines imposed by the state.

9. Incentive Programs

Applicants who complete their filings during the month of October, 2024 through March 31st, 2025 are eligible to receive one additional free quarter of processing for the 4th quarter of 2024. This incentive is subject to the conditions outlined above, including maintaining good standing and timely submission of required data.

If you have questions regarding any service please contact our agents

(240) 544-0960